2023 ANNUAL REPORT UPDATE

We are excited to share that in 2023, we provided access to 48 Kiva loans for a total of $480,000 through our Kiva Hubs. Additionally, we helped 7 entrepreneurs access grants through the SEED initiative, Immigrants Rising (for a total of $35,000).

In 2023 Kiva launched the Endorsement Incentive program to allow endorsed applicants to receive the full loan amount they apply for. The Centro Capital Hub helped 17 entrepreneurs benefit from the Endorsement Incentive program, receiving the maximum loan amount of up to $15,000. Kiva recently started offering borrowers the opportunity to build business credit through Kiva, and 15% of our borrowers are building credit through their Kiva loans.

In 2023, we focused on connecting entrepreneurs with different sources of capital, including loans, grants, and 1-1 business coaching services. Our primary motivation was to create more significant links with local resources and take advantage of the different alternatives offered by the market to keep small businesses in operation. 30% of Kiva loan applicants are Centro graduates.

Another essential change last year was to bring a closer connection between our Capital Hub, workshops, and 1-on-1 business advising support to address the different challenges small businesses faced. Lastly, we added new functionality to the Centro Business Planning App to help entrepreneurs easily discover and connect with local resources, including microlenders and Centro for Kiva loans.

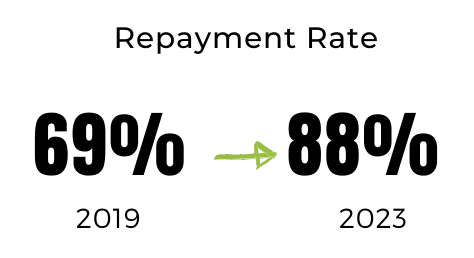

We have continued to improve the repayment rate to 88% (from 69% in 2019), showing the commitment of borrowers to pay their loans on time, as well as the positive use of the Centro Business Planning App. All borrowers not backed by an organization are required to go to the business planning activities on our app, which helps them think through their business model which mitigates the risk of them falling behind on repayments.

The businesses that accessed our Centro Capital Hub are mainly led by women (72%), immigrants (60%), people of color, Latinx (55%), and Black (38%).

BUILD CREDIT WITH KIVA

Kiva US announced they are now introducing the ability for entrepreneurs to build their credit as they pay back their Kiva loans.

If you are an entrepreneur with crowdfunding on Kiva.org, your loan profile will indicate that you will be building business credit with the help of this Kiva loan.

Commercial reporting has no restrictions on any type of business, but it is essential that you provide Kiva with your accurate business information, as this information is used to generate the credit report.

Decisions related to finances are affected by the information present in your business credit report, including:

The extent of business credit a supplier will offer

What repayment terms you can expect from other lenders

What interest rates you’ll be charged by other lenders

The credit or funding you may receive from a bank or lender

How your customers perceive your business

CAROLINA SHARES WITH US HER EXPERIENCE WITH HER KIVA CAMPAIGN!

Meet Carolina, owner of Metanoia Zone LLC, a company dedicated to the personal growth and development of teenagers and their parents; they offer courses in 5 areas of development and 1:1 coaching sessions.

Carolina is an immigrant woman born in Caracas, Venezuela. She studied marketing and bioanalysis, which allowed her to develop skills such as team leadership, conferences and speaking engagements, and coaching. She’s the co-owner of Metanoia Zone LLC, a company dedicated to supporting mothers of teenagers in resolving family and relationship conflicts. Carolina expresses, “As a mother, coach, NLP Practitioner, and speaker, I can bring value to parents and teens through the e-learning platform created mainly to address their main challenges.”

This Kiva loan is helping Carolina scale and purchase all the necessary technology to provide a quality service. Specifically, funds will go to buying inventory and hiring an employee and an assistant accountant.

Learn more about her Kiva campaign here.

Please let us know if you or someone you know is interested in accessing a Kiva loan or have any questions. Carlo Arellano, Capital Access Manager: carlo@centrocommunity.org